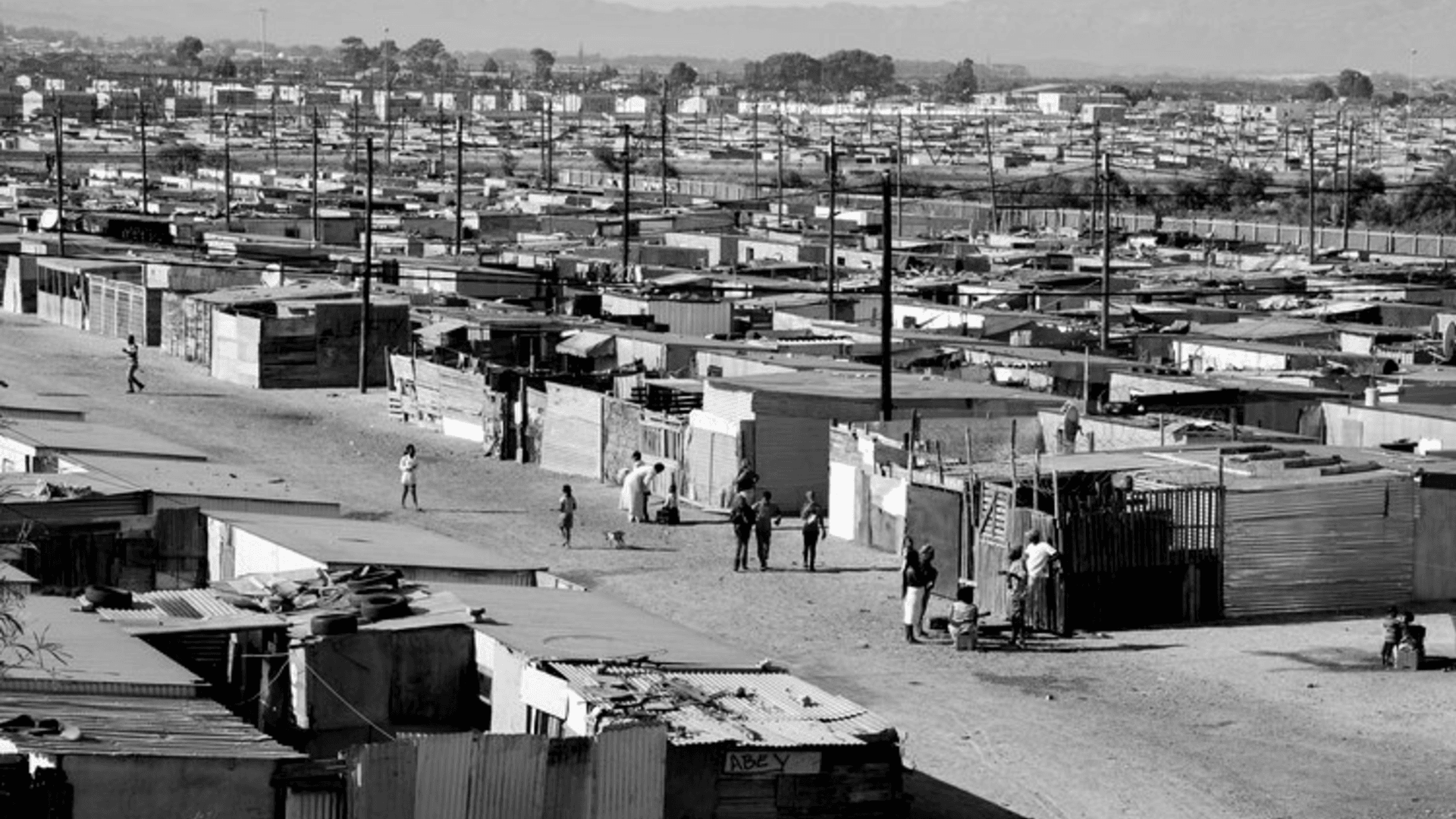

"Nations fail today because their extractive institutions do not create the incentives to save, invest and innovate."

Economic growth and investment in South Africa is set to recoil following several years of economic and political decline. South Africa, like other emerging markets, has a critical need to attract investment while at the same time driving economic transformation.

Over the past few years the government has set up funds to assist businesses grow in spite of the shrinkage in the economy. Despite these efforts, the complexity of regulatory procedures remains a major obstacle for SMEs and entrepreneurs. Furthermore, the challenges of barriers to entry and intense competition from established corporates are crippling SMEs.

Types ofInvestments

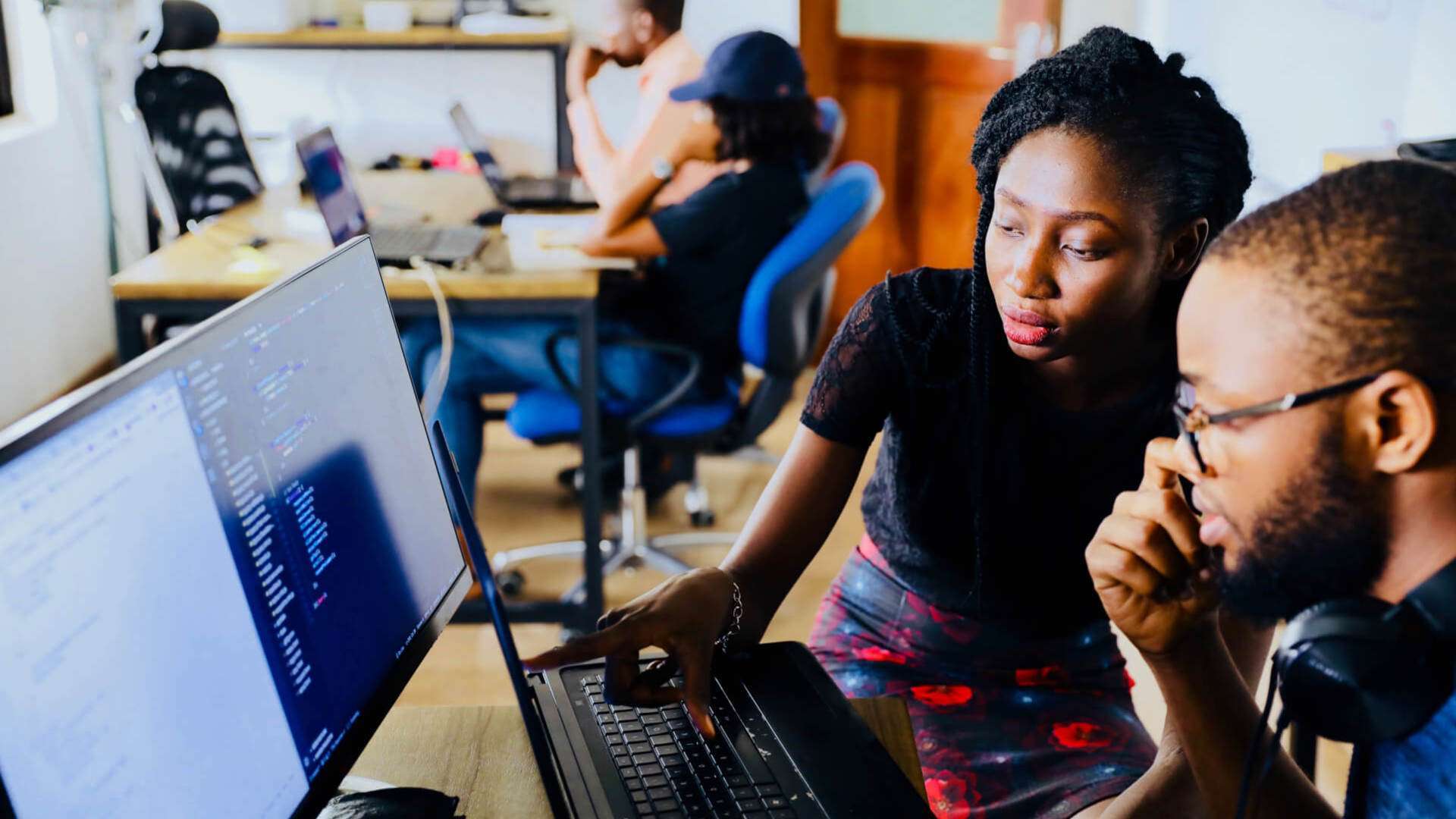

Venture Capital

Do you require financing for your early-stage venture that has high growth potential, or which has already demonstrated high growth? Our team of experts are always ready to engage with young, innovative and niche business enterprises. We are able to support an entrepreneur’s growth strategy in a challenging market place.

Benefits of partnering with Empowerment Capital in raising venture capital:

- Minority investments

- Black economic empowerment and ongoing social development

- Strategic network support

- Thorough financial acumen

- Strategic support and excellent corporate governance

- Patient capital to support the growth of your business

Our selection requirements:

- Significant personal investment or “sweat equity”

- Strong entrepreneurial management team

- Good product / market fit

- Scalable growth opportunities

We take minority interests in good growth opportunities without any predetermined exit strategy.

Our investment philosophy promotes that an entrepreneurial management team remains in control of the operation of the company. Our objective is to provide the necessary guidance to achieve exponential growth through supporting the management team’s growth ambitions.

Our purpose is to ‘transform lives through investment’ and black economic empowerment is the cornerstone of our existence. We acknowledge however that the intent of black economic empowerment was to create an ‘all-inclusive’ ‘growth strategy’ for all South Africans.

Furthermore, we are proud to be associated with leading South African corporate companies that share a common belief and desire to support SME’s that adopt all-inclusive growth strategies and sustainable business strategies vis-à-vis black economic empowerment and social development.

Growth Capital

Taking your business to the next level may require extensive capital that is not readily available. Typical examples include funding equipment acquisitions, product expansion, entry into new markets, increased capacity to achieve production efficiencies and new product development. Lenders consider SMEs high risk and offer capital with restrictive terms and conditions, at high interest rates and demand security – which is usually the family home. We are constantly reminded that SMEs are the engine of the economy, but the engine won’t function without petrol, which in this case is growth capital.

Growth capital is popularly known as expansion capital which serves as an acceleration to business expansion.

We aim to invest in strong entrepreneur run businesses to help grow them and in turn grow the South African economy.

Our approach to growth capital is:

- To be aligned with the investees business strategy, ensuring that this achievable and setting relevant milestones;

- Building long term relationships with our investees, as we have a long term growth view in the companies we invest in;

- Unlocking the potential of our investees to compete with large corporations;

- Our investment takes the form of significant minority investment because we believe that the entrepreneur is an expert in their field. We want the entrepreneur to retain control of their business and to continue to drive growth and take up opportunities to improve competitive advantage;

- Providing strong financial acumen to ensure that each project is assessed from a financial and risk perspective; and

- Investment returns in the form of the growth of our investees businesses.

In addition, we are also able to offer potential investees networking opportunities with our strategic partners who want to match their existing businesses, networks or skillsets with growing SMEs. This partnership can provide opportunities to escalate the SMEs growth to a point where they could become substantial enterprises and market leaders within their sectors.

Private Equity

In an economy that is in contraction yet is in dire need of capital and business growth, it is imperative to align oneself with a partner who provides value, guidance and expansionary foresight. At Empowerment Capital, we live by the ethos Mastery, Purpose and Autonomy - the principles our investment thesis is driven by.

With an adept understanding of structuring complex transactions in BEE, debt and equity, we offer a variety of private equity solutions.

Leveraged Buyouts & Management Buyouts

Through our relationship with various financing institutions, we can assist in raising the principal leverage necessary for the purchase of businesses in need to a growth partner. We partner with strong management teams seeking to independently manage already successful business units housed in large parent companies. Typically, we seek businesses with a revenue R500million or and EBITDA of R50 million. Capital investment opportunities are also available for investees with R20 million to R50 million in revenue.

Our criterion for investees is:

- Three to five-year performance track-record;

- Strong and experienced management team;

- Strong market positioning;

- Clear, pre-determined growth plan;

We provide the following advantages as value investors:

- Market access, networks and business development

- Strategic insights for efficiencies and competitive advantage

- Value-generating BEE accreditation

We believe that success and value can only be accrued through decisive, phased action and wise investing, hence we declare ourselves as long-term interest partners with no intention of burdening our investee’s with exit horizons.

Due to our investment thesis, we do not favour buyouts of current shareholders. We believe in partnering with our potential investees, hence upon investment we expect our shareholders to equally dilute their equity interest and continue with us in taking the investee company to its zenith.

Supplier Development

We believe that an opportunity is best left in the hands of an entrepreneur. To this extent, we believe in partnering with strong entrepreneurs that do not require spoon feeding but appreciate a partner that comes that adds value to the entrepreneurs aspirations in a supportive role. Globally, it is commonplace for SMME’s to be the job motor and economic nucleus for developed and emerging economies. We believe that through linkages to corporates, Enterprise and Supplier Development can be the catalyst for South Africa’s economic revival.

We partner with South Africa’s largest corporates in establishing investment vehicles designed for identifying strong enterprises and furnishing their growth through investment which allow for rapid scalability.

Our solution differs from typical Enterprise and Supplier Development initiatives by virtue of us making investments into companies identified by key procurement personnel in cognizance of the enterprises deemed imperativeness to the corporates long term supplier strategy. Once identified, we pair an investee with a strong black industrialist keen on adding substantial value to the enterprise.

Investee benefits of partnering with Empowerment Capital for supplier development:

- Vested long-term interest from a corporate.

- Growth capital for expansionary purposes.

- Potential strategic off-take agreements at increased volume or more beneficial terms.

- Direct-line relationship management assistance.

- Strong black industrialist incentivized to commercially perform value-adding activities in the business.

Corporate benefits of partnering with Empowerment Capital for supplier development:

- Most commercially appealing Enterprise and Supplier Development opportunity.

- Strategic alignment between buyers and supply chain.

- An autonomous high-performing business unit.

- “Feel-good” stories of grooming of new-age black industrialists.

- Unmatched BEE scorecard recognition.

Our purpose is to ‘transform lives through investment’ and black economic empowerment is the cornerstone of our existence. We acknowledge however that the intent of black economic empowerment was to create an ‘all-inclusive’ ‘growth strategy’ for all South Africans. To this extent, we continue seeking out great investment opportunities alongside corporate South Africa and its supply chains.

OurInvestments

01/21

TOP